Contents:

Since you cannot sell obsolete inventory, it is considered a loss and can cut into profit margins. In this article, we discuss how to avoid, identify, reduce, and manage obsolete inventory to ensure a more profitable business. For example, on December 31, we decide to dispose of $10,000 of the obsolete inventory goods that we have in our warehouse as we can not sell them at all due to their obsolete state. The process of the disposal of these obsolete inventory goods is to discard them completely as they no longer have value on the market.

- Because these products cannot be sold, they can take up valuable space and resources that could otherwise be used to store more profitable items.

- But neither is it the most expensive and many businesses choose to process payments with Wave for the convenience of using a single service for payment processing and accounting.

- While writing off small amounts of inventory is often unavoidable, obsolete stock doesn’t need to be such a big contributor to liabilities on the balance sheet.

- After looking at 10 years of financial reports, Jane determines that 1% of gross inventory never gets sold because pet food expires and a small amount gets stolen or damaged.

- Average Costing If your system does not track each delivery of inventory separately, then you need to apply a single cost to each item when you value the inventory .

Obsolete inventory, also called “excess” or “dead” inventory, is stock a business doesn’t believe it can use or sell due to a lack of demand. Inventory usually becomes obsolete after a certain amount of time passes and it reaches the end of its life cycle. You can sell them at a discount, bundle them with other products, liquidate them through surplus resellers, try to remarket them to a different audience, or do a complete inventory write off. Though obsolete inventory can still impact ideal profit margins, putting items on sale can help replenish some of the costs by attracting bargain shoppers. Businesses may end up with obsolete inventory when they fail to accurately forecast demand based on historical sales data, market trends, and other factors.

If a particular car model is no longer being produced, the parts that go with it become obsolete and cannot be sold. The company that manufactured these parts will have to write them off, as they are no longer of any use. When the government changes regulations, it is vital to adapt quickly and modify your products to meet the new standards. Compliance is essential, and ignoring new laws could cost your company dearly.

Mike’s Inventory Management Blog

This results in a decrease in the company’s net income and a reduction in the value of the company’s inventory. For companies selling physical products, there’s a fine balance between holding too much inventory and too little. Inventory management, customer behaviour and business experience will usually help get the balance right and avoid excess inventory.

Companies can commit fraud by incorrectly reporting the value of their inventory reserve. Upon closer inspection, the accountants realize the company wrote off hundreds of thousands of dollars’ worth of product last year, much of it 1080p LCD televisions. Its forecast called for 1080p TVs to be big sellers, but far more people bought 4K and OLED sets instead. A purchasing manager made matters worse by buying 200 more 1080p sets than the forecast called for in exchange for a lower price per TV. The following table of features for inventory control and inventory management systems can help you decide whether you need one of the systems or both.

Implementing the SLOB Inventory KPI in your company

Provides actionable https://1investing.in/ from your data There are many advantages of using a multifunctional operating system for managing your inventory accounting. One is that it allows you to collect varied accounting and inventory data to generate actionable insights that have value to other departments besides accounting. Admittedly, FreeAgent is geared towards UK-based businesses, though, so its usefulness outside of the United Kingdom is limited. That being said, the company does have plans to expand internationally and is definitely one to watch in the small business accounting software space. In addition to unlimited income and expense tracking for as many business partners and bank accounts as you need, Wave also offers a simple invoicing tool that connects seamlessly to an online payment processing system.

PROPHASE LABS, INC. Management’s Discussion and Analysis of Financial Condition and Results of Operations (form 10-K) – Marketscreener.com

PROPHASE LABS, INC. Management’s Discussion and Analysis of Financial Condition and Results of Operations (form 10-K).

Posted: Wed, 29 Mar 2023 07:00:00 GMT [source]

Inventory obsolescence reserve is a contra-asset account that reduces the carrying value of your inventory on the balance sheet. It reflects the amount of inventory that you expect to write off, dispose of, or sell below cost due to various reasons, such as damage, spoilage, expiration, obsolescence, or changes in customer preferences. Inventory obsolescence reserve is also known as inventory allowance, inventory reserve, or obsolete inventory reserve. Inventory write-off refers to the removal of inventory from a company’s financial records and accounting system because it is no longer usable or saleable. A write-off is usually done when the inventory has become obsolete, damaged, expired, or lost.

Accounting for Consignment Inventory for Vendors

The store is able to charge more for the set once they add champagne—and days sales in inventorys continue to purchase the bundle. Best of all, the company is now covering its costs and has avoided a write-off altogether. These industries are at high risk of obsolescence because demand for them is often seasonal and/or trend based.

Until there is a clear understanding of the market and production, it would make sense put further purchases on hold. The path from valid inventory to obsolete inventory usually passes through the phases of slow-moving, to excess, to obsolete for both raw materials and finished goods. Slow-moving inventory still has some value but sells at a much lower rate than is optimal. Obsolete inventory has reached the end of its product lifecycle, that is to say, it hasn’t been sold or used in a long time and is unlikely to be in the future.

In this stage of the product life cycle, there is no market demand for the product. The end of the product life cycle is typically determined based on a set period of time with no sales for that specific product offering. When you make a sale, you reduce your asset and increase your cost of sale, which transfers the inventory value from the Balance Sheet onto yourProfit and Loss reportor Income Statement. Whether this is done when the sale happens, or at month’s end when you run a stock take depends on which inventory accounting method you use, which we will look at in the next chapter. The cost for shipping and taxes will appear as a loss on your Income Statement or Profit and Loss report. To ensure accuracy and efficiency, sales order processing, profit and loss tracking, and asset management need to function from a single software platform.

Be used or sold, a business will usually write down or write off that inventory as a loss. Calculate the value of the damaged inventory at the end of the accounting cycle to write-off the loss. For either method, it’s handy to receive the inventory into a dedicated “location”. This could be a virtual aisle or a virtual warehouse, if you have a multi-warehouse system. This makes it easier to filter reports to separate owned inventory from consignment inventory. Your regular inventory is received into “1001 – Inventory” (assuming you’re using a Cost of Sales accounting method).

If you have fast-moving merchandise with long lead times, always keeping an amount of safety stock on hand will mean you don’t run out and disappoint customers. While food products might become obsolete when their expiration date has passed, clothing products might become obsolete when they’re no longer in style. John Freedman’s articles specialize in management and financial responsibility. He is a certified public accountant, graduated summa cum laude with a Bachelor of Arts in business administration and has been writing since 1998.

You must track this particular KPI weekly to ensure it is reduced over time. Growing numbers of retailers use the term deadstock to refer to obsolete stock which has become collectable. Sneakers are a great example, where customers are willing to pay a heavy premium to grab a limited edition pair. Unlike dead stock which can negatively impact sales, deadstock inventory can increase sales and boost a store’s desirability. Inventory control policies allow a business to manage the inflow and outflow of products, often assisted by technology. Discover how inventory control techniques affect stock prices and explore the importance of economic order quantity, quality control, and just-in-time inventory systems.

DIGITAL ALLY, INC. Management’s Discussion and Analysis of Financial Condition and Results of Operation. (form 10-K) – Marketscreener.com

DIGITAL ALLY, INC. Management’s Discussion and Analysis of Financial Condition and Results of Operation. (form 10-K).

Posted: Fri, 31 Mar 2023 20:50:12 GMT [source]

Think about when was the last time you conducted an inventory check, if an employee was committing fraud, would you able to identify how? Inventory visibility, it will be hard to understand how much of each product you need to restock and when (and what product might be worth discontinuing). As such, they might predict a much higher demand and end up ordering an excess amount of inventory. For most ecommerce business, having enough inventory to meet demand is often a top concern.

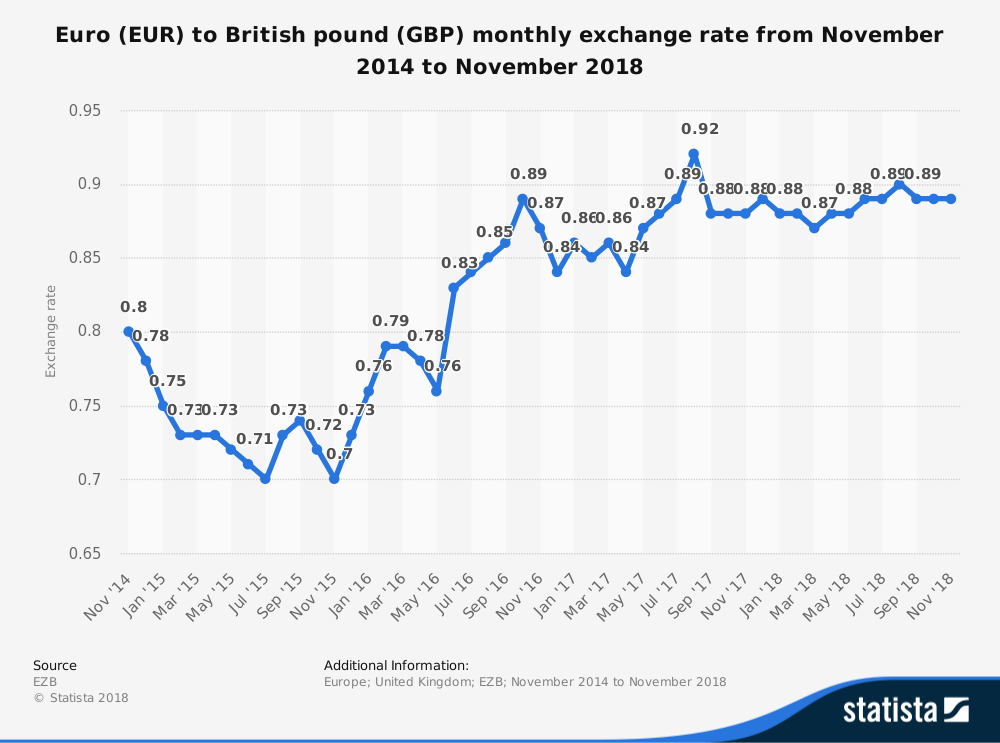

What’s more, your inventory management system also includes any applications you use in your order fulfillment processes. For example, your e-commerce platform at one end, and your distributor’s shipping management app at the other. The two methods of accounting for inventory go by different names in different parts of the world, so for consistency we’ll call these “Periodic” and “Cost of Sales”. There are cases where cost prices change significantly and regularly , which presents different ways to value inventory. But for the purposes of retail and wholesale, your inventory value is the net cost price. With a basic fee of €0.25 per transaction plus a 1.4% surcharge for European issued cards and a 2.9% charge for those issued outside Europe , Wave might not be the cheapest option for accepting online payments.