Content

Add double entry bookkeeping to one of your lists below, or create a new one. Some have suggested that the development of double entry bookkeeping would provide a powerful argument in favor of the legitimacy and integrity of usury but this is an obvious “non-sequitur”. Double entry bookkeeping, where each debit has a corresponding credit entry, will be used, which provides an arithmetic check of the books. Therefore when an EXPENSE is increased as a result of a transaction, it will be debited. When the LIABILITY is increased as a result of a transaction, it will be credited. IT systems, vehicles, machinery and other assets sometimes come with hidden costs that exceed their purchase price. Learn Total Cost of Ownership Analysis from the premier on-line TCO article, expose the hidden costs in potential acquisitions, and be confident you are making sound purchase decisions.

Credits add money to accounts, while debits withdraw money from accounts. Double-entry accounting also serves as the most efficient way for a company to monitor its financial growth, especially as the scale of business grows. This single-entry bookkeeping is a simple way of showing the flow of one account. However, it doesn’t tell you the full story of your finances. In fact, a double-entry bookkeeping system is essential to any company with more than one employee or that has inventory, debts, or several accounts. For example, an e-commerce company buys $1,000 worth of inventory on credit.

How to Use Double Entry Accounting

Contra Account 175, Accumulated depreciation, factory manufacturing equipment, is taken from the Account 163 value, to produce the Balance sheet result Net factory manufacturing equipment. From the example Chart of Accounts, below, you can see that that Accounts receivable and Allowance for doubtful accounts are both asset accounts. Allowance for doubtful accounts, however, is a contra-asset account that reduces the impact contributed by Accounts receivable.

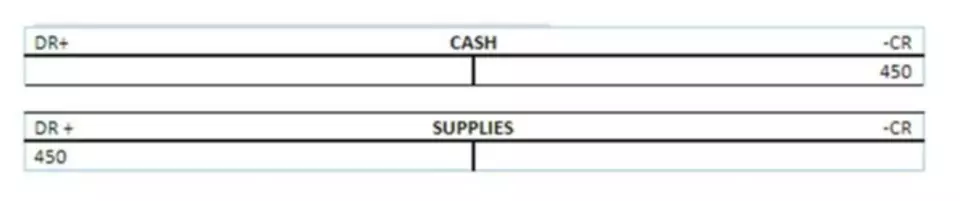

You buy $1,000 of goods with the intention of later selling them to a third party. The entry is a debit to the inventory account and a credit to the cash account. The accounts payable captures an owed payment to the supplier or vendor that must be fulfilled in the future, but the cash remains in the possession of the company until then. On the general ledger, there must be an offsetting entry for the balance sheet equation to remain in balance. That’s a win because financial statements can help you make better decisions about what to spend money on in the future.

Step 2: Use debits and credits for all transactions

Find the premier business analysis Ebooks, templates, and apps at the Master Analyst Shop. Rely on the recognized authority for your analysis projects. Knowing the true cost of individual products and services is crucial for product planning, https://www.bookstime.com/ pricing, and strategy. Traditional costing sometimes gives misleading estimates of these costs. Many turn instead to Activity Based Costing for costing accuracy. Take control of asset TCO and prevent nasty cost surprises later.

When determining the appropriate adjustment to cash, if a company receives cash (”inflow”), the cash account is debited. But if the company pays out cash (”outflow”), the cash account is credited. Single-entry accounting involves writing down all of your business’s double entry accounting transactions (revenues, expenses, payroll, etc.) in a single ledger. If you’re a freelancer or sole proprietor, you might already be using this system right now. It’s quick and easy—and that’s pretty much where the benefits of single-entry end.

Double Entry Accounting

Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses.

In each case above, incidentally, there is also involves an expense category account.These expense accounts appear on the Income statement, not the Balance sheet. In the first example, the expense account is “Bad debt expense” while in the second case, the account is “Depreciation expense for factory machinery.” In reality, even a small business may identify a hundred or more such accounts for its accounting system, while a large company may use many thousands.

Double Entry Bookkeeping Definition

Debits and credits are equal but opposite entries in your accounting books. If a debit decreases an account, you will increase the opposite account with a credit. Double-entry accounting is a method of accounting that makes simultaneous entries in two different accounts to balance debits and credits. Double-entry accounting helps to ensure accuracy and highlight errors in business accounts.

- For example, if someone transacts a purchase of a drink from a local store, he pays cash to the shopkeeper and in return, he gets a bottle of dink.

- In this system, the term “debit” just means that an entry is being made in the left column of a two-column entry system, while “credit” indicates an entry on the right side.

- How the bookkeeper and accountant handle each transaction for an account depends on which of the five account categories includes the account.

- This is because the assets of Lots of Fun Pty Ltd are increasing.

- Debit to Asset → If the impact on an asset account’s balance is positive, you would debit the asset account, i.e. the left side of the accounting ledger.

- Double-entry bookkeeping produces reports that allow investors, banks, and potential buyers to get an accurate and full picture of the financial health of your business.

And AuditorsAn auditor is a professional appointed by an enterprise for an independent analysis of their accounting records and financial statements. An auditor issues a report about the accuracy and reliability of financial statements based on the country’s local operating laws.

For instance, a company may have to part with some of its assets to acquire new assets, or it may have to spend some assets to reduce its liabilities. This article will get into why you should be using the double entry accounting system.

The system is designed to keep accounts in balance, reduce the possibility of error, and help you produce accurate financial statements. To enter that transaction properly, you would need to debit your cash account, and credit your utilities expense account. While having a record of these transactions is a good first step toward better managing your cash flow, this type of recording doesn’t make clear the impact each transaction has on your business. By using double-entry accounting, you can be sure all of your transactions are following the rules of the accounting equation. The entry is a debit of $10,000 to the cash account and a credit of $10,000 to the notes payable account. Thus, you are incurring a liability in order to obtain cash.

Modeling Pro is an Excel-based app with a complete model-building tutorial and live templates for your own models. Free AccessBusiness Case GuideClear, practical, in-depth guide to principle-based case building, forecasting, and business case proof. For analysts, decision makers, planners, managers, project leaders—professionals aiming to master the art of “making the case” in real-world business today. Free AccessBusiness Case TemplatesReduce your case-building time by 70% or more. The Integrated Word-Excel-PowerPoint system guides you surely and quickly to professional quality results with a competitive edge. Rely on BC Templates 2021 and win approvals, funding, and top-level support. The complete, concise guide to winning business case results in the shortest possible time.

What Is Double Entry Bookkeeping and How’s It Fit in General Ledger? – Investopedia

What Is Double Entry Bookkeeping and How’s It Fit in General Ledger?.

Posted: Sat, 25 Mar 2017 19:20:34 GMT [source]